Monetary authorities have been faulted for the “piecemeal” devaluation of the kwacha with analysts saying the current approach will delay the process to fully align the currency as structural issues have not been addressed.

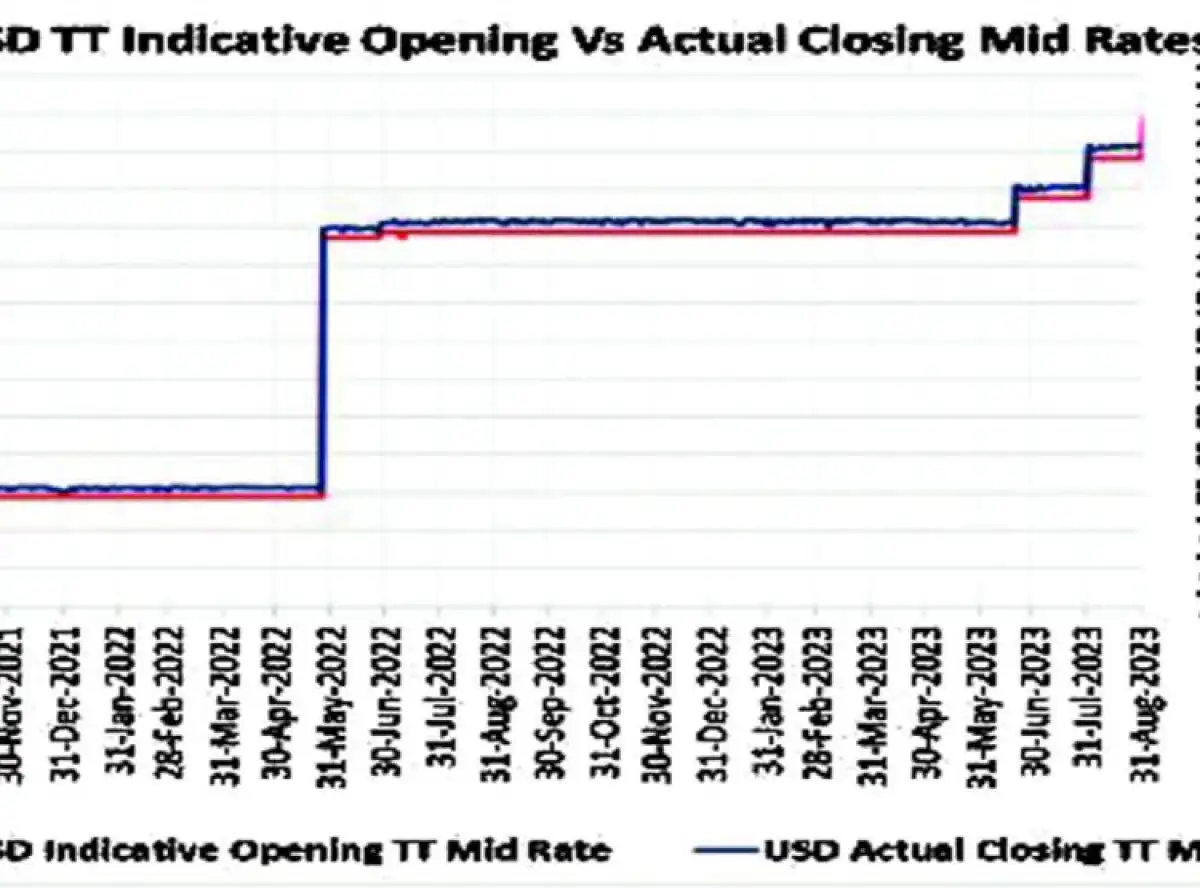

The reactions follow the 2.8 percent depreciation of the kwacha effective last Friday after the Reserve Bank of Malawi (RBM) conducted the third foreign exchange auction. The kwacha is now trading at K1 126 from K1 095 against the dollar.

In July, the kwacha fell by three percent while in June, it depreciated by 2.6 percent.

Speaking in an interview on Saturday, Financial Market Dealers Association of Malawi president Leslie Fatch said considering the impact of the sharp movement in the exchange rate, gradual alignments currently taking place serve better.

But he said the key is to ensure the process does not result in unnecessary speculation and panic.

Said Fatch: “Technically, one would think a full devaluation and a free-floating exchange rate suffices to ensure the rate aligns.

“However, such a decision would lead to deterioration of economic conditions, so there has to be a balance considering the socio-economic impact such a decision on the economy.”

Economist Edward Chilima, while indicating that the “piecemeal” approach is an attempt to determine the price of the dollar using market approach, said it only shows that the current official level of the kwacha is not realistic.

He said: “The danger could be that these auctions may lead to speculations. The piecemeal approach is raising speculations which may negatively worsen pressure on the currency.

“The fact remains that at the current official rates, the kwacha is overvalued. Reality is that the kwacha is trading at rated above the official rates.”

Economic statistician Alick Nyasulu said the best solution to achieve a strong kwacha is to export more by implementing export-friendly policies to boost exports.

He said: “RBM is doing its monetary duties, but exports growth is not their role.

“Unless we get practical and take export-oriented investments, foreign exchange shortages will continue forever putting in question the credibility of our currency.”

Meanwhile, the foreign exchange shortage remains acute with RBM data showing that gross official reserves decreased to $674 million or 2.70 months of import cover in July from $729 million equivalent to around 2.95 months of import cover.

The Economist Intelligence Unit has since projected that the kwacha will trade at K1 245 by the end of this year due to persistent foreign currency shortages and inflationary pressures.

The RBM announced in January this year that it will be holding forex auctions periodically to facilitate the discovery of a prevailing market-clearing exchange rate for the kwacha.

Comments (0)